how to work out vat from gross

We could not find a similar site that allowed users to change the amount of VAT so created this so that business users and individuals have access to a calculator where the VAT rate could be changed and VAT could be added to a net amount or subtracted from a gross amount in an easy manner. You will have calculated the amount including VAT which is known as the Gross Amount.

Vat Transactions Entries And Examples Accounting Taxation Example Accounting Entry

Lets think about what these figures mean before we go on.

. The UK VAT rate is 20 so you would do net figure X 12. The second way is the more simple as you use a VAT fraction which is 16 to calculate the VAT. If you want to add 125 VAT to a price or a sales invoice you just need to divide the amount by 100 and then multiply by 1125. How To Work Out Vat On Gross Price.

Welcome to our site. Envision the organization is a bookkeeping firm that reviews different organizations. An example of how value-added tax VAT works. So if the VAT rate was 175 the formula would be.

While gross profit margin is a useful measure investors are more likely to look at your net profit margin as it shows. South Africa VAT Calculator. To do this you simply divide the cost by 12. If you have a figure you want to add VAT against multiply by 020 to find the VAT value or 120 to find the gross value including VAT.

VAT Portion Total Debtors x 14114 R228 x 14114 R28. How to calculate VAT in Excel. If you have a gross price and need to figure out which portion is VAT you can use the following formula. Calculate your gross profit from retail price cost price and current margins using our handy GP calculator.

The value-added tax rate varies by country. For example if something cost 150 dividing it by 12 gives you the VAT-exclusive price of 125. So for example if our total debtors amount owing to the business is R228 R rands South African currency then we do the following. Check full VAT rates list below.

For example if the applicable standard VAT rate is 20 youll divide the gross sales price by 12. We have created this site due to the recent changes to VAT rates. Divide gross sale price by 1 VAT rate. Excluding VAT from gross sum.

We started the calculation with the net amount which doesnt include the VAT so is a VAT exclusive figure. Only 3 easy steps for VAT calculation. If you have a figure you want to add VAT against multiply by 020 to find the VAT value or 120 to find the gross value including VAT. The net amount is the value you use in your accounts for purchases and sales if youre a VAT registered company.

2 November 2016 Thank you very much Dinky. So for example if you pay 90 including VAT for a nights accommodation in a hotel and the hotelier has not itemised the VAT as a separate figure you know that your potential input tax claim is 10. How to calculate VAT. Check the VAT rate its preset to 23 percentage Enter the amount Net amount or Gross amount.

For example if you bought a table for a Gross price of 180 including 20 VAT and want to work out the Nett price excluding VAT you do this. Only 3 easy steps to calculate VAT online. Now its time to work out the the Gross from the Net in Excel. If you try this sum on the VAT Calculator you will see that it is correct.

10000 divided by 120 8333 Subtract 8333 from 10000 1667. If it is 15 then you should divide by 115 then subtract the gross amount multiply by -1 and round to the closest value including eurocents. This Excel Accounts Tutorial will show you how to work out VAT Net amount in ExcelSo if youre looking to finding out the Net. Some countries exclude certain goods or services from the tax.

We should take an assistance-based business. VAT calculation formula for VAT exclusion is the following. If the applicable VAT rate is 5 youll divide the gross sales price by 105. Multiply VAT x 6 to get gross.

You can then deduct 125 from 150 to work out the VAT on this purchase was 25. All you do is divide your Gross amount by your ratio. There is an easy VAT fraction of 19 with the 125 rate. How to remove VAT from a sum manually Divide the gross amount by 1 VAT VAT Rate is 20 so divide by 120.

3550 x 100 70. Divide VAT x 2 to get net. Click Remove VAT or Add VAT depending on what you want. 180 120 150 So the Nett amount excluding VAT.

Therefore 1667 is the VAT Amount on an item sold for 10000. Thats the way you want to tackle percentages in Excel. For example an invoice of 125 multiplied by 20 provides a VAT figure of 25. To calculate the gross VAT figure simply.

If you want to calculate the VAT portion and you only have the total of debtors or creditors you take this last figure and multiply it by 14114. Our 5 VAT Calculator allows you to calculate VAT forwards backwards or in reverse. March 17 2022 by Paulette Feldman. Check the VAT rate its pre-set to the SA VAT rate of 15 Enter the amount net or gross price.

A solitary review sells for 500 and costs 100 to create returning a gross benefit of 400. Gross NET 1175 Youre basically taking the total and adding 175. Gross profit margin is your profit divided by revenue the raw amount of money madeNet profit margin is profit minus the price of all other expenses rent wages taxes etc divided by revenue. If you want to subtract 125 from an amount you need to divide the amount by 1125 and then multiply by 100.

Think of it as the money that ends up in your pocket. To calculate VAT having the gross amount you should divide the gross amount by 1 VAT percentage ie. How to work out VAT. Multiply the net amount by VAT rate.

Gross NET 12 So whatever amount the Gross is you multiply it by 1 with the percentage 2 added on. It will be 23 in our example. An example would be 1000 net figure X 12 1200 gross figure including VAT. This is an edge of 80.

Multiply the net figure by 1. The easiest method is to calculate 1 first scale that up to 20 to calculate the VAT then add the VAT to the net to calculate the gross. In some countries VAT is called goods and services tax or GST. Simply enter your figure and check the correct VAT rate press the Add VAT button if you want to find the sum inclusive VAT or press the Remove VAT button to deduct VAT from the total.

COST PRICE RETAIL PRICE Item cost price ex. Prepare for the new 125 VAT rate. For example an invoice of 125 multiplied by 20 provides a VAT figure of 25.

What S The Formula For Vat Calculation In Excel Free Excel Training

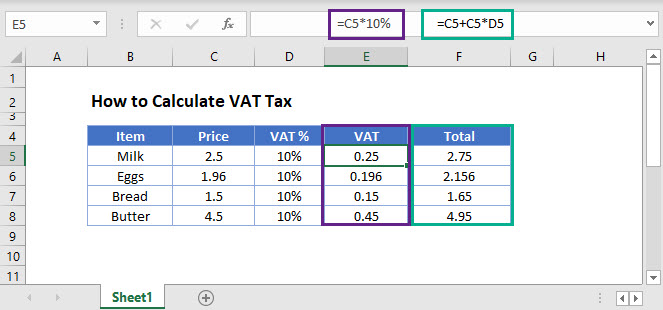

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Posting Komentar untuk "how to work out vat from gross"